does kansas have inheritance tax

Where you are doesnt matter. Another states inheritance laws may apply however if you inherit money or assets from someone who lived in another state.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

In addition there is no inheritance tax in Missouri.

. Living in a state without an inheritance tax may result in left-over assets and property. Here are some tax rates and exemptions that you should be aware of. Kansas does not assess an inheritance tax either.

If you live in kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. Pennsylvania has a tax that applies to out-of-state inheritors for example. Do you have to go through probate in Kansas.

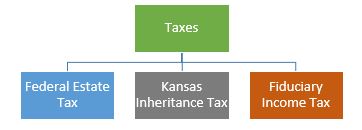

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. There are 12 states that have an estate tax.

Just five states apply an inheritance tax. If someone from out of state leaves you. There are 12 states that have an estate tax.

Just five states apply an inheritance tax. There is no federal inheritance tax but there is a federal estate tax. In this detailed guide of the inheritance laws in the Sunflower State we break down intestate succession probate taxes what makes a will valid and more.

May owe inheritance taxes to a different state however. And sometimes you could end up paying inheritance tax to another state if you inherit from somone who lived in one of the few states that does have an inheritance tax. You may also need to file some taxes on behalf of the deceased.

If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. In 2021 federal estate tax generally applies to assets over 117 million. That is a recent tax law change 2010.

Do you have to pay inheritance tax in Kansas. Kansas does have an inheritance tax but it is paid by the estate not the recipient. The estate will pay the taxes if a tax is due and liquidate assets or distribute them outright to beneficiaries.

Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances. Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island Massachusetts Connecticut Hawaii and the District of Columbia. Whats the inheritance tax in Kansas.

Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island. Kansas does have an inheritance tax but it is paid by the estate not the recipient. Kansas does not levy an estate tax making it one of 38 states without an estate tax.

Virginia does not have an inheritance tax. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. However if you are inheriting property from another state that state may have an estate tax that applies.

Finally there could also be a federal estate tax bill but only if the deceased person left millions in assets. Kansas does not collect an estate tax or an inheritance tax. State laws are constantly changing but here is a list of the currently listed states that are collecting estate tax or inheritance tax at a local level.

Another states inheritance tax may apply to you if the person leaving you money lived in a state that levies inheritance tax. That is a recent tax law change 2010. An individual that is a kansas resident that lives in kansas for all of 2019 who owned and occupied a home in kansas during 2019 who was aged 65 years or older for all of 2019 born before january 1 1954 and who had a household income of 20300 or less in 2019 shall qualify for a.

Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. New Jersey Nebraska Iowa Kentucky and Pennsylvania. However you may not be required to go through the formal process.

In Pennsylvania for instance the inheritance tax applies to anyone inheriting property from a Pennsylvania resident even if the inheritor lives in another state. Does kansas have an estate or inheritance tax. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Kansas does not collect an estate tax or an inheritance tax. We have already discussed the fact that Kansas does not have an estate tax gift tax or. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs. All Major Categories Covered.

You dont have a tax to pay. New Jersey Nebraska Iowa Kentucky and Pennsylvania. Just five states apply an inheritance tax.

If the estate meets the requirements it may qualify as a simplified estate. There are 12 states that have an estate tax. You should talk with an experienced attorney about how best to protect your inheritance or the wealth you are leaving to loved ones so you can reduce taxes or avoid taxes altogether.

In addition to lowering the gift tax exemption this also decreases the gift tax exemption. New Jersey Nebraska Iowa Kentucky and Pennsylvania. Maryland is the only state in the country to impose both.

While the state does not impose an inheritance tax or an estate tax this does not mean that no taxes are assessed as a result of a death. Select Popular Legal Forms Packages of Any Category. Kansas has no inheritance tax either.

Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island. These two states are maryland and new jersey. However another states inheritance tax rules could apply if you inherit money from someone who passes away in another state.

Does Missouri Have Inheritrage Tax. Kansas eliminated its state inheritance tax in 1998 and has not reinstated an inheritance tax as of March 2013. 16 states and washington dc.

If you want professional guidance for your estate planning after reading this article.

Estate Tax And Inheritance Tax In Kansas Estate Planning

What Happens To Property When There Is No Will Probate Inheritance Property

Kansas Is One Of The Least Tax Friendly States In The Us Kake

Kansas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Dave Ramsey Baby Steps Dave Ramsey Baby Steps Baby Steps Dave Ramsey

Pin By Jeff Cayton R3homegroup Real On R3homegroup In 2021 Estate Tax Inheritance Tax Arizona Real Estate